It’s not true that to acquire a customer costs 5-7x more than to keep one. Tommy Walker writes about it because many entrepreneurs reallocate budgets basing on soundbite statistics and end up with a disaster. It’s highly important to analyze your data to establish viable benchmarks and goals.

Walker describes various metrics associated with customer lifetime value and explores how this knowledge can be used to make data driven decisions.

Why it’s very important to determine your customer lifetime value

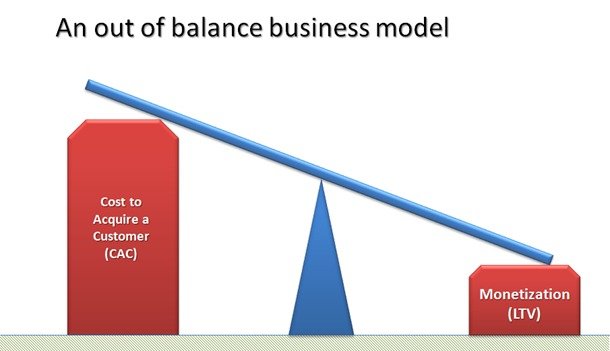

Venture capitalist David Skok says in his article that the main reason why startups fail is because their Customer Acquisition costs vs their Customer Lifetime Value costs often look like this.

It happens because many businesses focus on transactional customer value, and forget to invest in the experience that happens after the conversion

You should always remember that you need to invest in making the product better. The acquisition cost can significantly outweigh the amount how much we can make from a customer if we don’t concentrate on making existing customers happy.

David Skok says in his post:

“Life Time Value > Cost of Acquisition. (It appears that LTV should be about 3 x CAC for a viable SaaS or other form of recurring revenue model. Most of the public companies like Salesforce.com, ConstantContact, etc., have multiples that are more like 5 x CAC.)

CAC should be recovered in < 12 months (for subscription businesses)”

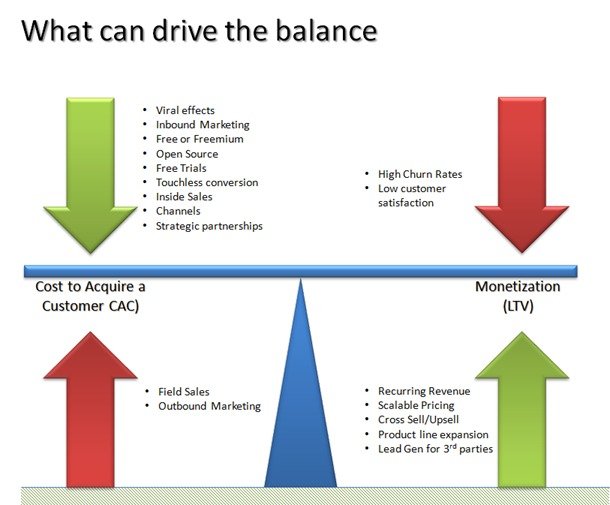

David also says that the key thing about improving your customer lifetime value is to create an ultimate balance in your business model which will allow you to offset the unavoidable high-cost factors that inevitably go along with running your business.

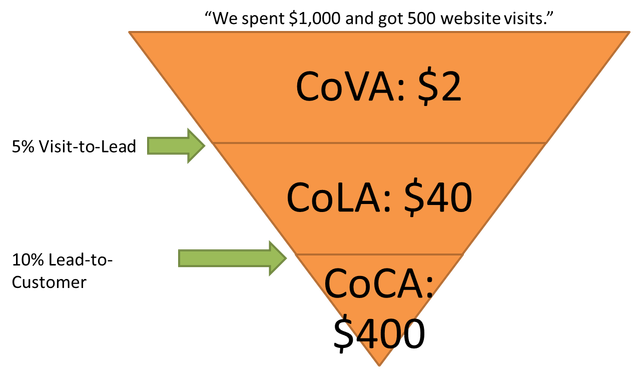

Determining your customer acquisition costs

The easiest way to find your customer acquisition cost is to divide the total amount of marketing dollars by the amount of actual customers that come from those efforts. (Marketing Spend/Customers = Cost Per Customer).

For those who want more details, Hubspot gives a great example:

- Cost of Customer Visits (CoCV).

- Cost of Lead Acquisition (CoLA).

- Cost of Customer Acquisition (CoCA).

Calculating your customer retention rate

Look closer at your customer retention rates. In order to find out the lifetime value of your customers, you need to know how long they’ll stick around.

Here’s what you need to know:

- Number of customers at the end of the period – E

- Number of new customers acquired during that period – N

- Number of customers at the start of the period – S

Once you have those the formula is pretty straightforward:

CRR = ((E-N)/S)*100

WARNING: Don’t carry out the calculation to find the average across your entire customer base! Such broad averages may give you damaging figures if you’re not careful enough.

The issue is that blending customers into an “average” significantly distorts reality. If you gain two customers – one with a retention rate of 100% and another with a retention rate of 0% – you can imagine how the situation would play out. The first customer would pay forever, and the second would leave right away. However, if you first average the two retention rates together, you’ll have two customers with a 50% retention rate.

From Corey Pierson on Custora

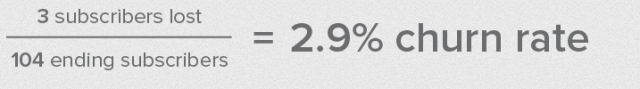

Calculating your churn

Churn is the rate of which customers (naturally) stop buying from you.

Ideally, calculating customer churn looks like this:

But Steven H. Nobel says it’s not that simple in this blog post on Shopify.

Here’s a formula to get a realistic view of churn rate for predictive analysis purposes:

![]()

with the weights being

![]()

“What this metric is useful for is keeping track of changes in customer churn behaviour while giving a rough estimate of what percentage of your customers will leave in the next 30 days.”

Steven also shared an interactive spreadsheet you can download to plug your own numbers into.

Calculating a more accurate customer lifetime value

This is a basic LTV equation:

(Average Value of a Sale) X (Number of Repeat Transactions) X (Average Retention Time in Months or Years)

But once again: remember that averages lie. It’s highly important to segment your users so you can get an accurate picture of the data.

If you want to know the lifetime value of your customers, consider the following segments that:

- pay for personal training & group coaching.

- buy supplements.

- pay for additional classes.

- buys t-shirts, gear, refreshments.

Also analyze the data to understand correlations between the users who stay and those who churn quickly.

- Do people who sign up for classes have a tendency to have longer retention rates?

- Is there any relation to people enrolling in personal training and supplements?

- Do high churn customers also buy more gear?

You’ll get a clear understanding about the value every customer type will bring to your business, if you find out the lifetime value of individual customer segments. You will also be able to make data driven decisions about how much to invest in acquiring each customer type. Moreover, you can use the data to create up-sells and cross-sells to increase the lifetime value of each customer segment.

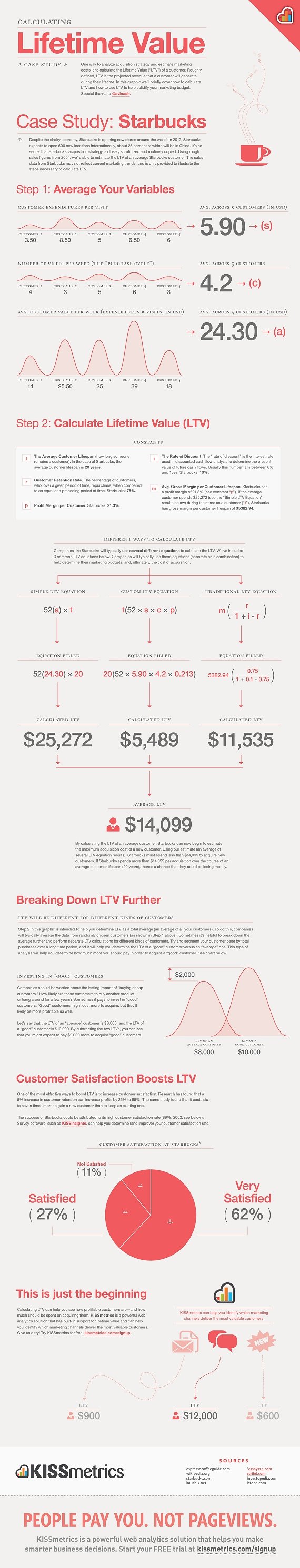

A hypothetical scenario – Starbucks

Infographic by KISSmetrics illustrates different ways to calculate customer lifetime value.

Despite the fact that there are some fundamental flaws, Tommy Walker still wanted to share it. He considers it to be a wonderful example of why you have to keep working with the data until you get something accurate.

What did the commenters find wrong?

- Averaging revenues + Profits (like they did with the total average) ultimately breaks the equation

- It doesn’t consider the costs associated with delivering the product

- It should factor in discounts & discounted profits

- The sample size (5 customers) is probably too low for a company like Starbucks

It’s very important to understand that data is unique for each particular situation and business.

So you can use the formulas as a starting point to understand the behaviour of your customers.

The effects of increasing customer lifetime value? (micro case studies)

Here are 3 case studies of companies which have got tremendous results after nailing their customer lifetime value:

- IBM Increases Revenue By 10x By Correctly Identifying & Marketing To High Spending Customers.

- SurveyMonkey Increases Customer Lifetime Value by 150% by Identifying Most Profitable Geo-Demographics.

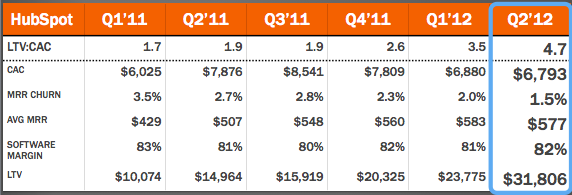

- Hubspot Reduces Churn by 57% & Increases CLV by 215.72% in a year and a half.

Conclusion

Here’s a quote from Forbes to sum up everything discussed in the article:

“Brad Coffey, head of corporate development for [Hubspot], likens the formula to a machine: Put a dollar in at the top and the LTV:CAC ratio will tell you roughly how many dollars come out at the bottom. If your money isn’t multiplying, “you’re going to want to spend some time tuning that machine”

Bonus: 6 quick tips to improve customer lifetime value

- Use Email to Pre-emptively answer common questions, upsell, and provide customer education.

- Cross-market & provide lead gen for companies with similar customer bases

- View every customer interaction as an opportunity to improve customer loyalty.

- Find ways to build habits around your product.

- Make customer service easy. According to Harris Interactive, 56% of customers will switch brands if the alternative offered more ways to connect.

- Incorporate customer feedback to improve everything from user experience to product features & design.

You can read the full version of the article here.