Here’s an article by David Skok which explains the key metrics essential for understanding and optimization of SaaS business.

As SaaS business is more complicated than any traditional business, metrics for traditional business can’t capture the main factors that drive SaaS performance.

David Skok will help you to answer the questions:

- Is my business financially viable?

- What is working well, and what needs to be improved?

- What levers should management focus on to drive the business?

- Should the CEO hit the accelerator, or the brakes?

- What is the impact on cash and profit/loss of hitting the accelerator?

What’s different about SaaS?

You’ll get the revenue for the service in SaaS along with various recurring revenue businesses only over a long period of time (the customer lifetime). If users like the service, they will use it for a long time (and your profit will also increase), if users don’t like the service, they will leave it fast (your business will lose money spent on customer acquisition). So there are 2 things you should do:

- acquire a customer.

- keep a customer.

The SaaS P&L / cash flow trough

The majority of SaaS business lose much money during the first years of existence. It happens because they have to invest aggressively to get users but they need to wait for a long time before they can get the profit. David Skok points out that “the faster the business decides to grow, the worse the losses become.”

Unit economics

It may be rather a difficult task to understand whether a SaaS business is financially viable due to the fact that there are many losses and expenditures in the beginning (in order to become successful, companies spend a lot on getting users).

You need to answer the question:

Can I make more profit from my customers than it costs me to acquire them?

You’ll need 2 metrics:

- LTV – the lifetime value of a typical customer.

- CAC – the cost to acquire a typical customer.

Is your SaaS business viable?

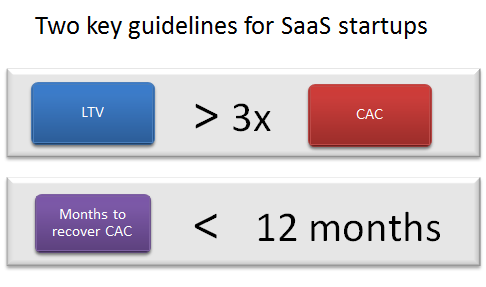

Here are 2 guidelines which will help you to understand whether your SaaS business is viable.

How to use the SaaS guidelines

- The CEO must decide when to hit accelerator pedal and expand. The guidelines help to understand whether a SaaS business is OK or has some problems you should work on.

- The guidelines can also be used for evaluation of different lead sources (Google AdWords, TV, Radio, etc.) as they have various costs.

- You can also use them for segmentation. Find out what segments have the highest LTV to CAC or quickest return.

2 types of SaaS business:

- the ones with primarily monthly contracts, with some longer term contracts. The main focus is on MRR (Monthly Recurring Revenue) here.

- the ones with primarily annual contracts, with some contracts for multiple years. The focus is on ARR (Annual Recurring Revenue), and ACV (Annual Contract Value).

3 contributing elements to SaaS bookings

There are 3 contributing elements to how MRR changes relative to the previous month:

- New MRR (or ACV).

- Churned MRR (or ACV) (from existing customers that cancelled their subscription; this will be a negative number).

- Expansion MRR (or ACV) (from existing customers who expanded their subscription).

Net MRR or ACV Bookings is the sum of the three.

How important is Customer Retention (Churn)

In the beginning, it doesn’t matter a lot. But when your business has grown significantly, the situation changes. 3% churn for a hundred customers and a million customers is 3 and 30,000 users correspondingly.

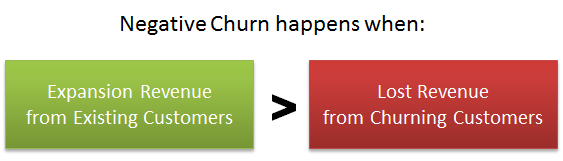

Negative Churn

David Skok is sure that “the ultimate solution to the churn problem is to get to Negative Churn.”

You can get this expansion revenue by:

- Using a pricing scheme with a variable axis.

- Upselling/Cross-selling them to more powerful versions of your product, or additional modules.

Getting paid in advance

It’s a great idea if you don’t impact bookings. It can give you the cash flow that can cover money problems we mentioned in the beginning of the article. It’s always good to offer discounts as it encourages such behavior.

Getting paid in advance often helps to lower churn rate because users made a deep commitment to the service.

David Skok also explains how to:

- calculate CAC and LTV.

- carry out cohort analysis.

- predict churn.

- use funnel metrics in forward planning.

The original article may seem a little bit complex but it will give you a deep understanding of the main key metrics in SaaS business.