PayPal remains the undisputed leader in the sphere of payment processing. People around the world require to pay for their purchases on ecommerce platforms, send and receive money for private purposes and do this in a simple, convenient, and safe way.

People are looking for good-working support and better terms for their payment system. They want to be sure that their money will safely rich the recipient. The more needs for online payments are, the more cases of online fraud appear, so both sellers and buyers suffer.

PayPal suits these requirements, it has a user-friendly interface and secure tools for eсommerce: invoicing, reporting, and processing payments. Though PayPal is very popular, a great number of people are just used to it. Yet, if fact, they have a choice. There are a lot of online payment systems that can compete with PayPal in terms of the commission, client service, and usability. They also have benefits and drawbacks, so let’s consider what tool can potentially replace your usual payment system.

Contents

1. Shopify Payments

If you already have a Shopify store, you know about Shopify Payments, an inbuilt payment processing system that is proposed to the Shopify store owners by default. In this case, you shouldn’t set up a third-party payment gateway, you have a direct link between your online store and your payment system and can configure it in your Shopify account.

You also can sell offline with Shopify: Shopify Payments include POS hardware for accepting in-store payments.

Shopify Payments are more profitable for Shopify store owners in financial terms. So, if you use PayPal on your Shopify store, you should pay from 0.5 to 2% transaction fees above for card processing. If you use Shopify Payments, you pay only for card processing and its cost is based on your Shopify plan.

Let’s see, the lowest rate is 2.4% plus $0.30 per transaction, and the highest rate is 2.9% plus $0.30 per transaction. All the following payouts will be charged every 3 working days, while PayPal charges in 5-7 working days.

For Shopify Payments

- Seamless payment management for Shopify store owners

- No transaction fees

- Integration with third-party payment systems and ecommerce solutions

- Lightweight accounting and reporting through collaboration with various accounting applications

Against Shopify Payments

- Shopify Payments are available only in several countries.

- Every chargeback costs $15.

- Shopify security systems can freeze the account without warning.

2. Payline

Payline is a payment processor that works with online, mobile, and in-store payments. This is an example of the classic ecommerce checkout system that is well suited for in-store payments. In the case of a retail business, Payline is cheaper and more flexible than PayPal.

There are no fixed fees; pricing is calculated based on a formula: pricing system plus interchange. This way payments change depending on the types of processed cards. Anyway, this will cost you less than the PayPal fixed rate for offline transactions (2.7%).

Such a way is clear to understand but makes the process of budget planning more complicated.

You can choose a certain Payline package with the needed features. For example, small business owners that require mobile card readers should pay their attention to low-priced Spark or Surge packages.

Representatives of a larger business can purchase the Payline Shop package that includes tabletop card readers as well as a lot of useful features and resources for card processing.

As for commercial transactions, PayPal will be the winner.

Let’s sum up the pros and cons.

For Payline

- Flexible and clear pricing structure (pricing plus interchange)

- Several packages of in-store credit card processing that also include the needed hardware

- Low-cost offline transactions

- Mobile payments

- Fully-functional API for convenient integration with third-party solutions

Against Payline

- Payline is available only in the US.

- Pricing structure complicates cost planning.

- The solution is not suitable for commercial transactions.

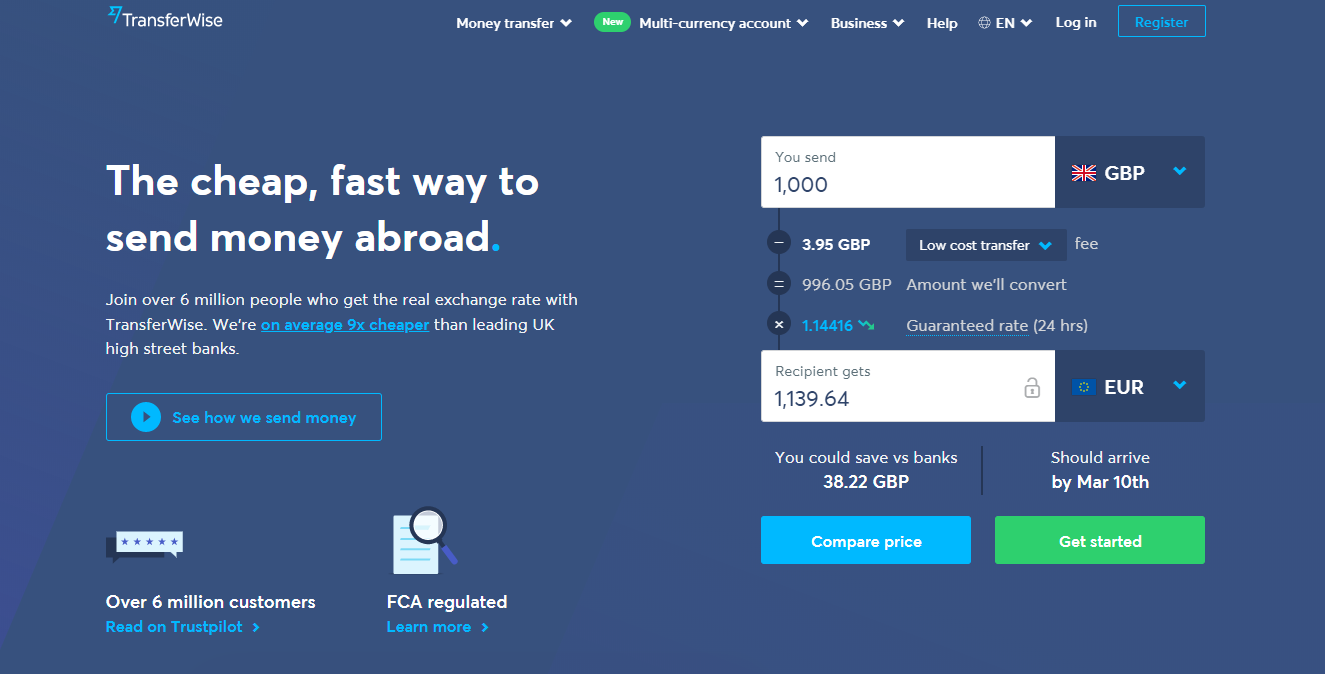

3. TransferWise

TransferWise is like a cheaper version of PayPal for international transfers with more than 4M customers.

This is a good working solution for sellers, buyers, and freelancers from all over the world: they can use TransferWise multi-currency borderless account with low fees.

The secret of success of TransferWise is the usage of one upfront transfer fee without hidden charges. TransferWise also has a special system of money transfer. Let’s see how it works: for example, you are in the US and you need to send money to your friend in Spain. You transfer your money on TransferWise American account, and it, in turn, pays your recipient from TransferWise Spain account with the exchange rate. This scheme provides low rates and makes money transfer fast and convenient: in fact, money always stays in the country.

For TransferWise

- TransferWise is a well-known inexpensive way to transfer money all over the world.

- Money doesn’t leave the country, it leads to low costs and fast transfers.

- TransferWise has a clear pricing system.

- TransferWise supports transfers in 50 types of currencies.

Against TransferWise

- It works only as a bank transfer, you can’t send or receive money in another way.

- You can receive bank details only for several types of currencies: GBP, EUR, AUD, NZD, USD, and PLN.

- There are no additional convenient features as the recurring billing.

4. Square

Square is not an ordinary payment processor, that seems an interesting solution when you are choosing between PayPal and something else. Square is a complex solution for business, which includes an online store with free domain, shopping cart, ability to invoice, save card information, and use virtual terminal functions. You can manage card processing with free POS and mPOS integration.

Also, small business owners can use features for booking an appointment, employee management, and payroll.

Square is available only for businesses that are located in the UK, UA, Canada, Japan, and Australia. Merchants from these countries can accept credit card payments and use various interesting features of Square. In the above countries, Square is a well-known payment solution and has a lot of users.

Square works with classic rates, as well as other payment processors: in-store card processing costs 2.75%, invoices and online payments cost 2.9% plus $0.30.

For Square

- Square includes an online store and a free domain.

- Square allows its customers to use a full-fledged payment processing system.

- Square includes additional useful features for small and growing companies.

- Square hasn’t monthly fees.

Against Square

- Square as a payment gateway is available only for several countries.

- Square accounts can work unstable as they belong to a third-party payment processor.

- It doesn’t suit business with a high rate of risk.

5. 2Checkout

2Checkout is the payment processor that allows customers to accept payments from all over the world. 2Checkout strives to extend the list of countries from which you can receive payments that make this payment processor a decent competitor of PayPal. 2Checkout fees in the US are the same as PayPal has, but other countries can have more profitable conditions.

For 2Checkout

- There are no monthly fixed costs in 2Checkout.

- It covers more than 200 countries.

- 2Checkout works with more than 45 payment methods and 100 billing currencies.

- It is available in more than 30 languages.

- It offers shopper support 24/7.

- 2Checkout has more than 300 security rules for transactions, which increases fraud protection.

- Several kinds of checkout options are available on mobile devices.

- It provides recurring billings for customers.

- It gives its users the ability to connect a merchant account with the payment gateway.

Against 2Checkout

- Payments from all countries except the US have a 1% fee.

- Chargebacks cost $20.

- Currency conversion is about 2-5% of the daily bank exchange rate.

6. Payoneer

Payoneer gives its customers the ability to use a debit card and online account. You can use the ATM or pay for purchases at the shop with Payoneer debit card. Online shopping, receiving and sending money operations are simple and convenient. Also, Pioneer is available worldwide for marketplaces and persons who work directly with clients.

For Payoneer

- Payoneer provides useful features for freelancers, including worldwide payments.

- Payoneer is available all over the world.

- A simple process of creating the account and implementing the transactions system.

- It provides the ability to use both a bank account and ATM.

- It offers clear monthly billing and free payments between the Pioneer accounts.

Against Payoneer

- Fees for transferring money to the bank account. For example, PayPal provides this feature for free;

- There is no Payoneer payment gateway;

- It requires 3% fee in case you work with credit cards.

- It requires a $3.15 fee per withdrawing via ATM.

7. Skrill

Skrill payment platform has equal to PayPal rates and fees but compares favorably with Skrill debit card and user-friendly interface. When the customer sends you international payments to your debit card, you can get it immediately. This card is acceptable anywhere, also including ATM.

For Skrill

- Simple account customization

- Fast sending/receiving money process (you need only the email address)

- High security

- Availability of the Skrill account all over the world

- Free (in most cases) sending and receiving of payments

- Ability to withdraw funds and winnings if you are a gambler or earn money playing games

Against Skrill

- Customer service is far from satisfactory.

- Skrill can freeze your account on suspicious of fraud.

- Service of sending payments to the email address or Skrill account costs 1% of the amount.

8. Stripe

Stripe is one of the most popular payment systems that works with several big ecommerce platforms, for example, Shopify. Shopify uses Stripe as the preferred payment processor.

If you use Stripe, you don’t need a merchant account and gateway. Stripe deals with all needed processes, including collecting payments and sending them to the bank. It also works with ACH payments and Bitcoin transactions. With these features, the Stripe basic fee is equal to PayPal.

For Stripe

- Automated money transaction to your bank account

- Availability of mobile payments including Apple and Android Pay

- Accepting payments all over the world

- Real-time fee reporting

- Clear payment system (you pay only for the used features)

Against Stripe

- You can’t use your money immediately after a transaction and should wait for several days.

- Merchant accounts are available in several countries by contrast with international payment acceptance.

- The usage of international cards requires 1% transactions additional fee.

- Interface customization requires some coding.

9. Google Pay

Google has the feature for storing and using both debit and credit cards, named Google Wallet. You can use your cards through the mobile phone and pay with them in different places and online.

For Google Pay

- You can use Google Business to accept your customers’ payments on your website or physical store.

- Sending/receiving processes don’t take a lot of time.

- Google Pay has a high level of security.

- No additional fees.

Against Google Pay

- Not all phones provide Google Pay. It is available only for iPhone and several Android versions.

- It is secure but not invincible; it is about the transaction process. The transaction leaves a record, and it is not totally safe from intruders or hackers.

- The availability of this kind of payment depends on the NFC technology.

10. Authorize.Net

This payment system has a lot of fans in ecommerce. Web store owners highly appreciated reasonable pricing, level of customer support, and a user-friendly interface. You can’t use Authorize.Net for private purposes if you want to send and receive money from your friends and relatives.

For Authorize.Net

- Authorize.Net is used by about 400,000 merchant customers.

- It has a high level of security.

- It provides free 24/7 customer support.

- It offers free setup of payment gateway and merchant account.

- Free mobile application and swiper are available when you create the account.

- Authorize.Net provides synchronization with QuickBooks, the accounting software.

Against Authorize.Net

- There are no personnel finance and sending tools like PayPal has.

- The monthly charge for the usage of the gateway is about $25.

- In the case of international transactions, it suggests a 1.5% fee.

- It has high chargebacks: $25.

11. Intuit

This popular payment system provides a lot of tools for your business needs: TurboTax, QuickBooks, and Mint. So, it is the best solution if you want to use QuickBooks for accounting.

For Intuit

- Intuit includes a set of useful business tools.

- It supports mobile payments.

- It accepts ACH payments.

- Intuit allows for using the Pay Now button on your website.

- It provides a connection between payments, timesheets, and payroll.

Against Intuit

- It is not suitable for personal kind of payments.

- It is an expensive choice if you don’t need QuickBooks integration.

12. Dwolla

The main feature of Dwolla is its specialization in ACH bank transfers. It also works with business and private payments and has much in common with PayPal.

Dwolla doesn’t work as a payment processor; it connects transactions straight to the bank account. Dwolla is about sending money with the lowest price with the help of any device that has Internet access. For example, the processing of payment less than $10 is free, and every transaction has a fixed rate of $0.25. Compare the Dwolla $0.25% fee and the PayPal $2.9% rate per transaction.

For Dwolla

- It has user-friendly tools and an interface that simplify transactions.

- There is a fixed rate for next-day transactions.

- It requires a low transaction fee ($0.25).

- It provides immediate payment transactions.

- Dwolla allows its customers to automate mass payouts.

Against Dwolla

- Both the sender and receiver should use Dwolla to make payments.

- The Dwolla account is available only in the US.

- Dwolla has high monthly payments.

13. Braintree

Braintree system is at the same time a PayPal service and a PayPal alternative. Despite it has several features for personal payments it more often uses by merchants. It provides payment gateway, recurring billings, and a place to store credit cards.

For Braintree

- Clear pricing and solid customer support

- Special marketplace payment system with a wide set of features

- Acceptance of any kind of payment, including cards, PayPal, and Venmo

- Works with online and mobile payments

Against Braintree

- You need a separate merchant account.

- Braintree implementation requires programming experience.

- It has a wide range of additional fees except for transaction fees.

14. WorldPay

WorldPay payment processing platform works around the world and can accept different ways of payment, credit and debit cards, online and offline card transactions. So, WorldPay is a good solution for ecommerce and in-store payments.

You can use WorldPay POS-systems, ATM, accept mobile payments and cash.

WorldPay has a diverse pricing system with tiered and interchange-plus plans. Your monthly payment depends on the score of monthly processing and transaction history. Offline card processing costs 2.9% with a $0.30 transaction fee.

For WorldPay

- Works worldwide

- Provides a lot of ways of offline processing

- Has flexible pricing with the interchange-plus system

- Has 24/7 customer support

Against WorldPay

- It requires contracting for 3 years.

- Its early termination costs are $295.

- Usage of its free terminal entails an additional fee.

15. Amazon Pay

Amazon Pay offers fast payment processing, like PayPal does, but doesn’t cover ACH payments or bitcoin transactions. It works by analogy with Facebook and keeps all information about the user. So, when customers place an order with the Amazon Pay system, they don’t need to fill personal information every time.

For Amazon Pay

- Amazon Pay is known for its secure and fast transactions.

- It has a clear sign-up process and a user-friendly interface.

- The transaction fee is the same as in PayPal.

Against Amazon Pay

- The integration of Amazon Pay with a web store requires some coding.

- Usage of Amazon Pay includes random fees, like domestic processing fee and cross-border processing fee.

16. Klarna

Klarna is a payment processor driven by AI. Klarna is able to calculate potential risks for the person according to pre-filled information, time of purchase, and transaction history. After analysis of these data, Klarna confirms or rejects the purchase before an order implementation. Customers have 14 days to pay for their orders.

Klarna is very convenient for your online customers and accepts risks instead of them.

For connecting with the bank, you shouldn’t sign up in service, it will be enough to fulfill your standard banking requisites and authenticate. After this procedure, the payment transfers to the merchant account.

For Klarna

- Convenient for customers: they can pay for purchases after delivery or pay in installments;

- Simple order registration process;

- Customers don’t pay for the return of the goods;

- Merchants pay for the usage of the Klarna processor upon checkout.

Against Klarna

- Customers’ orders can be declined after Karna analysis.

- Customer service needs improvement.

- The customer money back process requires some time.

17. WePay

WePay is the card processing solution that specializes in online payments and crowdfunding. Its security features and API perfectly suit such transactions.

It is an interesting fact that WePay supports various third-party payment services except for PayPal.

WePay has a clear payment system: every card transaction fee is 2.9% plus $0.30, every ACH payment processing is 1% plus $0.30. There are no additional fees.

For WePay

- WePay provides a flexible API.

- It offers fast start of your account work.

- It has cheaper ACH payment processing.

- There are no monthly payments, you pay on for what you use.

Against WePay

- There is no functionality for in-store card processing.

- WePay can’t accept payment from PayPal.

- WePay ecommerce features should be more reliable.

There is a wide range of services that can be used as a PayPal alternative. They all have both benefits and drawbacks. In some cases, they may be inferior to PayPal, but in others, they may be more profitable and convenient. Merchants and freelancers around the world can find something that suits their requirements in the best way. What about you, do you use PayPal or one of its alternatives? Tell us in the comments below!