Lars Lofgren is a project manager at KISSmetrics. He likes helping young SaaS-services and he writes for KISSmetrics and his own blog regularly. In this article he offers extremely useful information and we are happy to share it with you.

Is everything OK with your SaaS-service?

It’s difficult to answer as we’re always busy with various KPI, metrics and thoughts on how’s our business doing. But instead of using information for evaluation of our progress we start focusing on metrics that make it clear but which are, actually, useless.

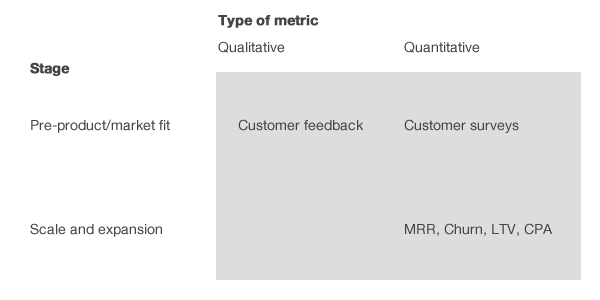

A SaaS-business may need several basic metrics which require your whole attention. Their priority changes as you grow.

In this article Lars Lofgren reveals the truth about metrics for this or that growth stage of a SaaS-business.

What it gives you:

- When you focus on a couple of metrics, you simultaneously concentrate on several problems of your business that should be solved for further growth.

- Data doesn’t mean anything until you use it. Each of these metrics helps to clearly understand how you’re doing and you understand where to apply your efforts and time.

- Each stage has 2 metrics that balance each other. It will keep you from concentration on one metric. It will also save you from the harm which can be caused to your business later on.

Contents

1. Before Product/Market Fit

You have just decided to start your own business and you have big plans on conquering the world. But firstly you need to make sure that your product is ideal for market.

There’s usually a period for beginners when customers don’t actually want what you offer. So, there are 2 options: aim at a different target audience or change your product to fit the market. And you do it, it’s product/market fit.

You’re on this stage, if:

- You have just started.

- You don’t know who your ideal client is.

- People evaluate and test your product for the first time.

It’s the first serious hindrance on your way. But how can we evaluate the progress, if we don’t have data? You don’t even have paying clients (or a few). Tests won’t help you in this case.

Here’s the solution: we will use quantitative indices and 1 important survey question.

Priority goals:

- Validate your assumptions by talking to your target audience. If people ask about your product before you try to sell it to them, it’s a sign that you’re moving in the right direction.

- Carry out surveys. Get 40% of clients who say that they would be disappointed if they couldn’t use your product.

Metric #1: Qualitative feedback

Technically it’s not a metric. In any case it’s too early for using metrics, however, you can get feedback. Right now you have only one goal: create a right product for the right market. The best way how you can do it: speak to your clients.

If you already have clients, talk to them via Skype and try to understand what professional problems they have. Ask them to tell about you how they tried to solve those problems previously. Then, show them your product and make them excited. You can use the following tips:

- Ask usual real life questions in order to understand who are you talking to.

- Ask deep questions on the existing problem.

- Try to give them your product as a solution for their problem for feedback (don’t sell a product, just try to get comments on it).

You’ll need at least 10-20 suchlike conversations.

If you don’t have clients, don’t get upset. Just go and search for people who may be interested in your product. It’s better to talk to 10 people via Skype rather than rebuild or rebrand your product.

When you start gathering feedbacks (especially on as you’re getting closer to the later stages of your business), use surveys, feedback forms and usability tests. But when you’re on an early stage, try to communicate with your clients directly. It’s essential to understand every detail.

“Carrot Quest allows to see live how clients use your product (where did they come from, their names, what they are doing now and so on). You can also interview them in a chat, ask several questions and help them to study your product”.

«Carrot Quest still communicates with clients every time when they have global updates or service changes. A new feature? Ask your clients whether they like it. Have fixed something? Ask your clients’ opinion».

Metric#2: Measuring product/market fit

It sounds nice but actually there’s one little problem with client feedback. It’s very difficult to measure it objectively: is a client really interested in our product? Are we taking into account only positive comments, leaving out negative ones?

Fortunately, there’s one cool question:

How would you feel if you have to stop using our product?

- Very disappointed.

- A bit disappointed.

- Not disappointed (as it’s not really useful).

- I don’t use this product.

Send this question to the clients who have already used your product. You need to have at least 40% of clients who would say “Very disappointed”.

If you can’t get this amount of clients, may be you should reposition your product or pivot entirely. If you meet the 40% benchmark, it’s time to move on to the following stage.

2. Start of growth

So, your product fits the market ideally. You have revenue and a growing client base. Now it’s time to move on with your business.

Till this moment you didn’t really need to track anything. User signups, revenue and that’s it. Now there are 2 new metrics which will help your business to move in the right direction.

You’re on this stage, is:

- you have at least one permanent channel for client acquisition.

- many of your users subscribe to your newsletters and pay you.

- monthly revenue starts growing.

Priority goals:

- constant MRR growth (regular monthly revenue) with Churn Rate control.

- fix monthly churn at the level of 1-2%. If it increases to 5%, try to decrease it by all means.

Metric #1: Monthly recurring revenue.

In a SaaS-business, MRR is a more valuable metric than traditional revenue. It’s the total revenue you got during a month from a monthly subscription to your product.

A SaaS-business depends heavily on recurring revenue. It can take months to regain the cost of a customer acquisition and real profit increases when the number of subscriptions to your product grows. Tracking MRR, we evaluate the progress of your business month-to-month.

Unfortunately, tracking MRR may confuse you. There are several cases when a system has to work with other variants:

- Making up yearly plans, don’t get too enthusiastic, neglecting monthly plans. Yearly revenue should be evenly divided among all subscription months.

- Plan changes are difficult to track. Don’t forget to add several dollars to MRR in case your client has changed a $10/month plan to a $50/month one.

- Don’t forget to display churn in MRR.

Metric #2: Churn

MRR increase is only one side of the coin. Churn is another one. If you can’t keep customers subscribed, it won’t be too long before MRR won’t grow and your business will stall.

Churn is a difficult thing. At the beginning of your business 10% Churn Rate doesn’t seem that bad. 100 client per months and 10 left. But if you have 10000 and 1000 left in a month? Even for the best marketing specialists it will be a hard time.

Churn rate doesn’t scare us in the beginning. But later on it may get out of control, if you don’t pay attention to it. In order to build a strong company with a serious approach, you NEED to work with churn rate and control it.

What’s a good churn?

It’s different for various spheres, but the universal requirement is: less than 5%, 1-2% is great. Negative churn is amazing. It’s a situation when a loss from clients who left is covered by the fact that existing clients started paying more.

3. Expansion

Sooner or later, you’ll face a wall: the main customer acquisition channel works slower and fewer and fewer clients return. In order to grow further, you need to find new ways to grow.

Try affiliate programs, new advertising networks, PR, business development, referral programs, new types of content marketing and other marketing types which are effective now. Choose, try and use what fits you.

You’re on this stage, if:

- growth is getting slower.

- the improvement of your main client acquisition channel is getting more and more difficult.

- your successfully control churn.

As soon as you start trying new growth channels, you’ll need to focus on 2 metrics. They will help you to check your business and channels.

Priority goals:

- Keep your cost per acquisition to one third of your lifetime value.

- Get each customer to profitability within 12 months.

Metric #1: LTV

How much churn do you get from a client until he/she leaves? It’s critical for a SaaS-service to calculate LTV. It may take 6-12 months if you factor in acquisition, support and product costs.

On this stage clients “live” long enough, so you can calculate LTV. If your business is tenacious, add second-order revenue to the formula.

Metric #2: CPA

When we start experiment with new growth channels, it affects CPA momentarily. It’s the total cost of one customer attraction from a definite channel.

In order to calculate an average CPA, total app all your marketing and sales expenses and divide them by the quantity of acquired clients. You can go further and segment CPA by channels. It will show results of new channels.

It’s not difficult to experiment with new channels. A usual maths will help you to understand whether a channel works or not. CPA allows to evaluate a new growth channel and deal with the old ones. How much do you spend on one client from context advertising or from social networks? How many content marketing specialists are you ready to hire? You can track this with this metric.

The main rule: CPA is one third of your LTV. A client should become profitable in 12 months.

Conclusion

Use the following metrics for each stage of your SaaS-business:

- Product/market fit: a deep interview and the product/market fit question.

- Start of growth: MRR and churn.

- Expansion: LTV and CPA

You should remember that these stages aren’t isolated. Imagine a situation: you’ve hit a product/market fit and start growing. If you use AdWords for client acquisition, you will pay attention to your CPA. But Churn Rate is also important for you as you don’t know how long clients will be with you. Check your CPA in order to make sure that it’s useful. Otherwise, improve MRR and churn.

What about funnels? What about ARPU, active users, number of visits to signup and so on? Try to find the metrics you really need. The ones above-mentioned are the bare minimum.

P.S.

Carrot Quest – is a service showing information on your user and on its basis the service allows to activate a user better and increase conversion into purchase. Subscribe to Carrot Quest blog. You’ll find posts on business development in the internet from client acquisition to return and team management there.