Blockchain Development. Tokenization Platform

Although the real estate industry adopted digitalization belatedly, now more and more businesses want to jump on the blockchain and smart contracts train.

Converting property shares to tokens makes investing in property diverse and accessible for retail investors of all kinds, cutting out the middleman. That’s why the tokenized real estate market is expected to grow exponentially soon.

Our client also strived to unlock the potential of a new real estate investment tool – crypto tokens and seize new markets with the help of blockchain-based software. To attract potential investors to buy/sell/exchange tokens, they decided to build a “RealEstate tokenization” environment capable of issuing tokens and managing their sales and exchanges.

The WiserBrand team studied the business model and started to plan the type of tokenization we believed suited best, drafted the tokenization environment architecture and design.

We needed to create an environment from scratch where real-world assets get converted into tokens and are legally compliant with laws and regulations.

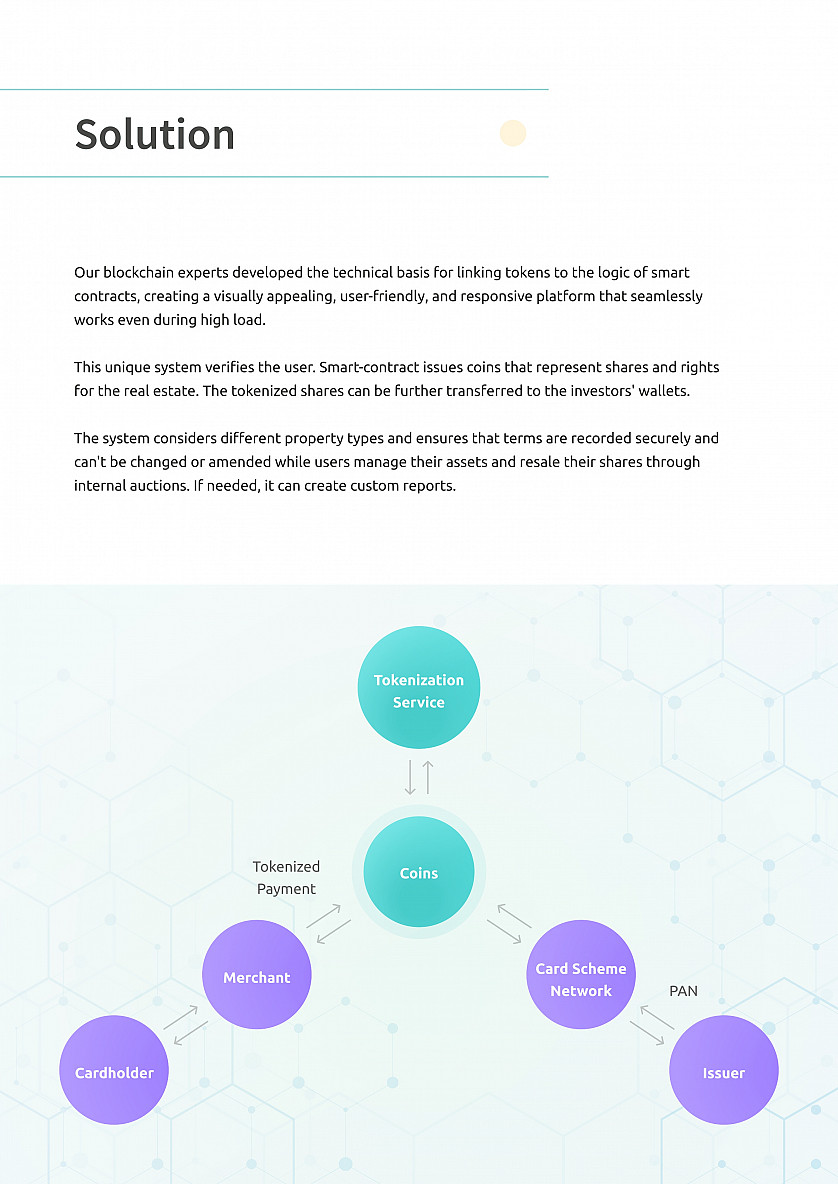

Our blockchain experts developed the technical basis for linking tokens to the logic of smart contracts, creating a visually appealing, user-friendly, and responsive platform that seamlessly works even during high load.

This unique system verifies the user. Smart-contract issues coins that represent shares and rights for the real estate. The tokenized shares can be further transferred to the investors’ wallets.

An instant and enjoyable tokenization platform with a blockchain-based structure covered the need to open access to investment opportunities. The product tokenizes real estate investments and provides a platform to find and choose the best investing possibilities, diversifying and mixing real estate assets.

We are inspired by the bar we set during this project, so we look forward to new experiences within this or any other business domain (rental, antiquity and art, stock splits, etc.)